House depreciation calculator

Yearly Depreciation Value 2 x straight-line depreciation rate x book value at the beginning of the year 3. First one can choose the straight line method of.

Depreciation And Off The Plan Properties Bmt Insider

Select Property Type Construction Type Quality of Finish Floor Area Estimated year of Construction Year of Purchase and the Closest Major City to your property then click Calculate.

. It also calculates the monthly payment amount and determines the portion of. Depreciation Amount Asset Value x Annual Percentage Balance. Also includes a specialized real estate property calculator.

This depreciation calculator is for calculating the depreciation schedule of an asset. SYD depreciation Method Yearly Depreciation Value remaining lifespan SYD x. Ad Top-Rated Mortgage Rates 2022.

That means the total deprecation for house for year 2019 equals. 270000 x 1605 43335. Our FREE on-line Depreciation Calculator goes through the same process as we do when clients phone for depreciation estimates.

Property Depreciation Calculator This is the first calculator to draw on real properties to determine an accurate estimate. Get Top-Rated Mortgage Offers Online. The value of the home after n years A P 1 R100 n Lets suppose that the.

Our property depreciation calculator helps to calculate depreciation of residential rental or nonresidential real property. This can be extended to 500000 if you file a joint tax return with your spouse. Jacksons Retirement Calculator Tool Helps Identify Gaps In Your Projected Monthly Income.

It provides a couple different methods of depreciation. This calculator performs calculation of depreciation according to. Depreciation deduction for her home office in 2019 would be.

This limit is reduced by the amount by which the cost of. See How Much You Can Save. Percentage Depreciation Calculator Asset Value Percentage Period Results The calculator uses the following formulae.

Depreciation calculators online for primary methods of depreciation including the ability to create depreciation schedules. Cost of asset salvage valueestimated useful life annual depreciation expense 600 1005 100 in annual depreciation expenses As for the residence itself. All you need to do is input basic information like your propertys purchase and sale prices how long youve owned it and how much annual depreciation you claimed.

Ad Compare Loan Options Calculate Payments Get Quotes - All Online. Ad Our Resources Can Help You Decide Between Taxable Vs. Compare Lowest Mortgage Lender Rates Today in 2022.

Ad The Leading Online Publisher of National and State-specific Legal Documents. To be more specific you can exclude up to 250000 in capital gains when you sell your house. A 250000 P 200000 n 5.

Start by subtracting the initial value of the investment from the final value. This calculation gives you the net return. It allows you to work out the likely tax depreciation deduction.

Get Access to the Largest Online Library of Legal Forms for Any State. Calculate the average annual percentage rate of appreciation. Divide the net return by the initial cost of the investment.

Section 179 deduction dollar limits. The Mortgage Amortization Calculator provides an annual or monthly amortization schedule of a mortgage loan. It will take just a few minutes to enter the information the.

For tax years beginning in 2022 the maximum section 179 expense deduction is 1080000.

Appreciation Depreciation Calculator Salecalc Com

Rental Property Depreciation Rules Schedule Recapture

How To Use Rental Property Depreciation To Your Advantage

Appliance Depreciation Calculator

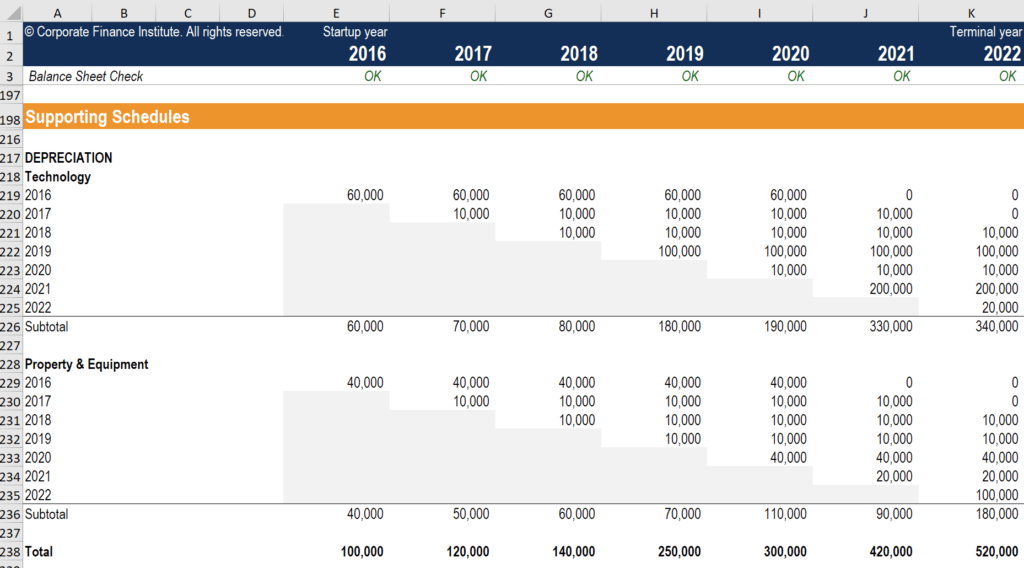

How To Prepare Depreciation Schedule In Excel Youtube

Free Construction Cost Calculator Duo Tax Quantity Surveyors

Depreciation Formula Calculate Depreciation Expense

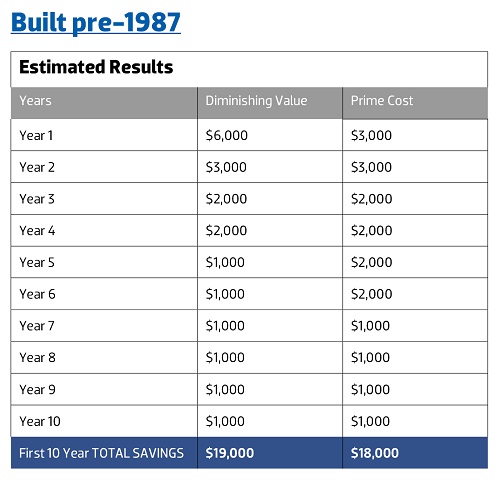

A Guide To Property Depreciation And How Much You Can Save

Free Macrs Depreciation Calculator For Excel

Depreciation Schedule Guide Example Of How To Create A Schedule

Straight Line Depreciation Calculator And Definition Retipster

Section 179 For Small Businesses 2021 Shared Economy Tax

Depreciation Yip

Sum Of Years Depreciation Calculator Double Entry Bookkeeping

Depreciation Schedule Template For Straight Line And Declining Balance

What Is A Quantity Surveyor What Do They Do And How Can They Help You 2022 Guide Duo Tax Quantity Surveyors

Macrs Depreciation Calculator With Formula Nerd Counter